In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals in need of immediate cash. Traditional lending institutions often require extensive credit checks, which can be a barrier for many potential borrowers. This case study explores the concept of rapid loans with no credit checks, examining their benefits, risks, and the implications for consumers and lenders alike.

The Rise of Rapid Loans

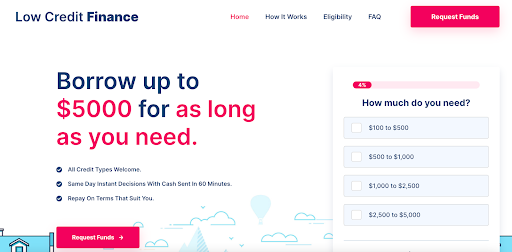

Rapid loans, often referred to as payday loans or cash advances, have gained popularity in recent years due to their accessibility and speed. These loans are typically small, short-term loans designed to provide quick cash to individuals facing urgent financial needs. The defining feature of these loans is that they do not require a credit check, making them appealing to those with poor or no credit history.

The Mechanics of No Credit Check Loans

No credit check loans operate on a straightforward premise. Borrowers can apply for a loan online or in-person, providing basic information such as income, employment status, and banking details. Lenders assess the borrower's ability to repay the loan based on their income rather than their credit score. This process allows for rapid approval, often within minutes, and funds can be disbursed almost immediately.

Benefits of Rapid Loans with No Credit Check

- Accessibility: One of the most significant advantages of rapid loans is their accessibility. Individuals with poor credit histories or those who have never borrowed before can obtain funds without the fear of rejection due to credit scores. This inclusivity can be a lifeline for many who would otherwise be unable to secure financing.

- Speed: As the name suggests, rapid loans are designed for quick access to cash. The application process is streamlined, and borrowers can receive funds in their accounts within hours, making it an ideal solution for urgent financial needs, such as medical emergencies or unexpected car repairs.

- Flexibility: These loans can be used for a variety of purposes, from covering unexpected expenses to consolidating debt. Borrowers can choose the amount they need, within the lender's limits, and use the funds as they see fit.

- Minimal Documentation: Unlike traditional loans that require extensive documentation, no credit check loans typically require minimal paperwork. This simplicity can be appealing to individuals who may not have the time or resources to gather detailed financial records.

Risks and Drawbacks

Despite their advantages, rapid loans with no credit checks come with significant risks that borrowers must consider:

- High Interest Rates: One of the most significant drawbacks line of credit without credit check these loans is the high-interest rates that accompany them. Lenders often charge exorbitant fees, which can lead to a cycle of debt if borrowers are unable to repay the loan on time.

- Short Repayment Terms: Rapid loans typically have short repayment terms, often due within a few weeks. This can create pressure on borrowers, especially if they encounter further financial difficulties before the due date.

- Potential for Debt Cycle: Many borrowers find themselves in a cycle of debt, taking out new loans to pay off existing ones. Should you have any issues relating to wherever along with how to utilize easy to get loans no credit checks; https://Gogorealestate.co.uk/,, you are able to email us from the webpage. This can lead to a spiraling financial situation, making it difficult to escape the burden of debt.

- Limited Regulation: The no credit check loan industry is often less regulated than traditional lending, which can lead to predatory practices. Borrowers may encounter lenders who engage in unethical behavior, such as hidden fees and aggressive collection tactics.

Case Study: The Impact of No Credit Check Loans on Consumers

To illustrate the impact of rapid loans with no credit checks, consider the case of Sarah, a 28-year-old single mother who faced an unexpected medical expense. After her son fell ill, Sarah found herself with a hefty medical bill that exceeded her monthly budget. With no savings and a credit score that disqualified her from traditional loans, she turned to a no credit check loan provider.

Sarah applied for a $1,000 loan, which was approved within minutes. However, the lender charged her an interest rate of 400%, with a repayment term of just 30 days. While Sarah received the funds quickly, the repayment amount was significantly higher than she anticipated. When the due date arrived, Sarah struggled to make the payment, leading her to take out another loan to cover the first one. This cycle continued for several months, resulting in mounting debt and financial stress.

Sarah's experience highlights the potential dangers associated with rapid loans with no credit checks. While they provided her with immediate relief, the long-term consequences were detrimental to her financial well-being.

Conclusion

Rapid loans no hard credit check with no credit checks offer a quick and accessible solution for individuals facing financial emergencies. However, the risks associated with high-interest rates, short repayment terms, and potential debt cycles cannot be overlooked. Consumers must approach these loans with caution and consider alternative options, such as credit unions or community assistance programs, that may offer more favorable terms.

As the demand for rapid loans continues to grow, it is essential for borrowers to educate themselves on the potential pitfalls and to seek financial advice before committing to any loan agreement. By understanding the implications of no credit check loans, individuals can make informed decisions that safeguard their financial futures.

In summary, while rapid loans can provide immediate cash relief, they are not without significant risks. It is crucial for consumers to weigh their options carefully and consider the long-term impact on their financial health before opting for such loans.