In today's financial landscape, personal loans have become a popular option for individuals seeking immediate funding for various needs, from consolidating debt to financing major purchases. Among the myriad of loan options available, the $50,000 personal loan with no credit check stands out as a unique offering. This article aims to explore the intricacies of such loans, their implications, and essential considerations for potential borrowers.

What is a $50,000 Personal Loan?

A personal loan is an unsecured loan that individuals can borrow from financial institutions, credit unions, or online lenders. The term "unsecured" means that the loan does not require collateral, such as a house or car, which is often required for secured loans. A $50,000 personal loan specifically refers to borrowing this amount, which can be used for a variety of purposes, including home renovations, medical expenses, or even starting a business.

The No Credit Check Feature

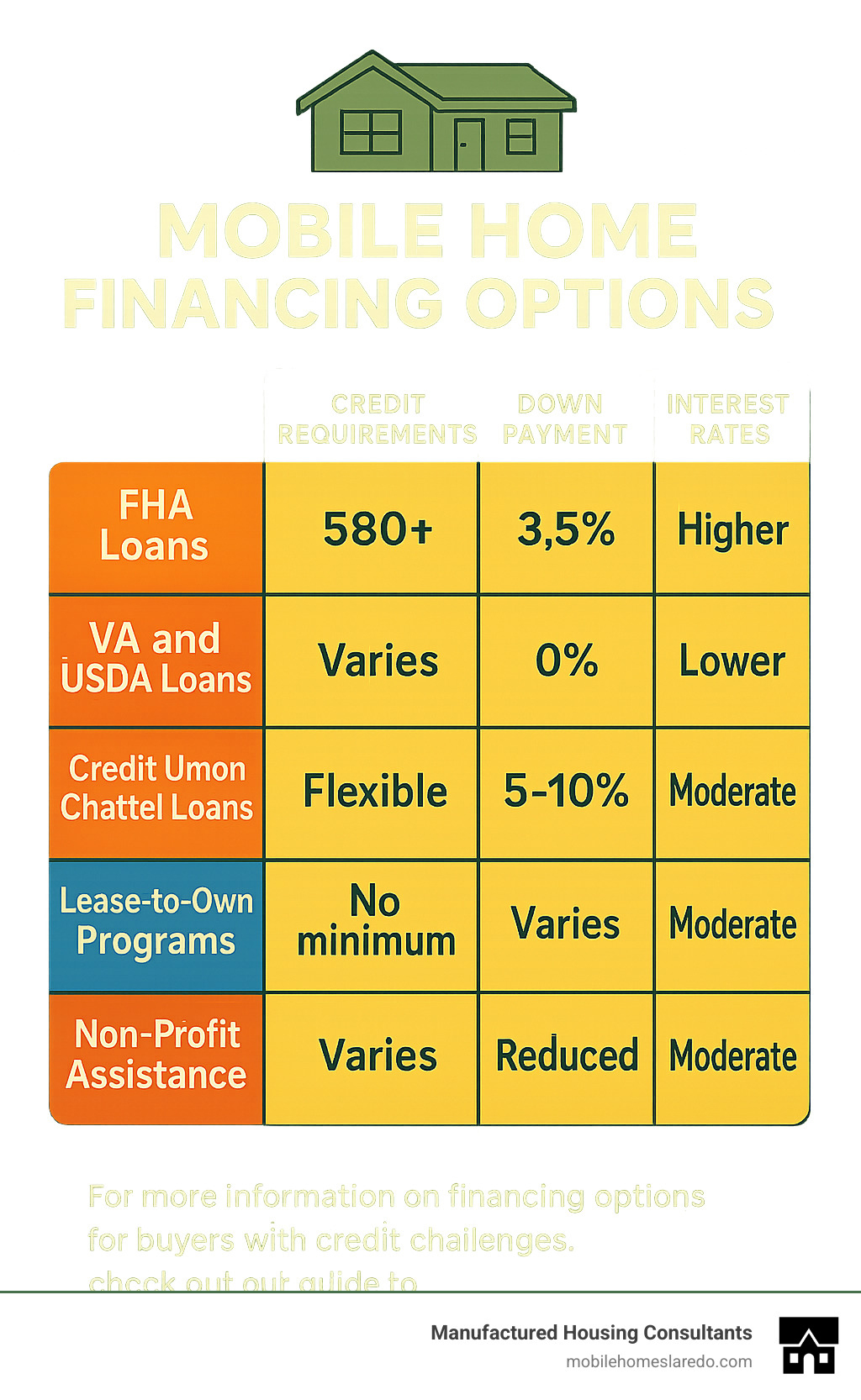

The no credit check feature is particularly appealing to those with less-than-perfect credit histories. Traditional lenders typically assess a borrower's creditworthiness through credit scores, which can significantly impact the approval process and interest rates. In contrast, lenders offering no credit check loans may rely on alternative methods to evaluate a borrower's ability to repay the loan, such as income verification, employment status, and banking history.

Advantages of $50,000 Personal Loans with No Credit Check

- Accessibility: The most significant advantage of these loans is accessibility. Individuals with poor credit or no credit history may find it challenging to secure traditional loans. No credit check loans provide an opportunity for these borrowers to access funds when needed.

- Speed of Approval: Loans without credit checks often have a streamlined approval process. Borrowers can receive funds quickly, sometimes within 24 hour online loans no credit check hours, which is crucial in emergencies or time-sensitive situations.

- Flexibility in Use: Borrowers can use the funds from a $50,000 personal loan for various purposes, giving them the freedom to address their specific financial needs without restrictions imposed by the lender.

Disadvantages and Risks

While the allure of no credit check loans is undeniable, potential borrowers must consider the associated risks and drawbacks:

- Higher Interest Rates: Lenders offering no credit check loans often compensate for the increased risk of lending to individuals with poor credit by charging higher interest rates. Borrowers should carefully evaluate the total cost of borrowing before committing.

- Shorter Repayment Terms: Many no credit check loans come with shorter repayment periods, which can lead to higher monthly payments. This structure may strain a borrower's budget and increase the risk of default.

- Predatory Lending Practices: The lack of regulation in some sectors of the lending market can lead to predatory practices. Borrowers should be cautious and conduct thorough research to avoid lenders that impose exorbitant fees or unfair terms.

Eligibility Criteria

While the specific criteria can vary by lender, most no credit check loans will assess the following factors:

- Income: Lenders typically require proof of a stable income to ensure borrowers can repay the loan. This may include pay stubs, tax returns, or bank statements.

- Employment Status: A steady job is often a key requirement, as it indicates reliable income and the ability to make consistent payments.

- Banking History: Some lenders may review the borrower’s banking history to evaluate financial behavior, looking for patterns of responsible management of funds.

How to Apply for a $50,000 Personal Loan with No Credit Check

Applying for a personal loan without a credit check typically involves several straightforward steps:

- Research Lenders: Start by researching lenders that offer no credit check loans. If you have any inquiries pertaining to where and ways to use borrow money instantly no credit check, you could contact us at our web page. Pay attention to reviews, interest rates, and terms to find a reputable lender.

- Gather Documentation: Prepare necessary documents, including proof of income, employment verification, and identification.

- Complete the Application: Fill out the application form provided by the lender, ensuring all information is accurate and complete.

- Review Terms: Carefully review the loan terms, including interest rates, repayment schedules, and any fees associated with the loan.

- Accept the Offer: If approved, you will receive a loan offer. If the terms are acceptable, you can proceed to accept the loan and receive your funds.

Alternatives to No Credit Check Loans

For individuals hesitant about the risks associated with no credit check loans, several alternatives may be worth considering:

- Secured Loans: If you have an asset to offer as collateral, secured cash loans instant approval no credit check may provide lower interest rates and better terms.

- Credit Unions: Many credit unions offer personal loans with competitive rates and more lenient credit requirements compared to traditional banks.

- Peer-to-Peer Lending: Online platforms connect borrowers with individual investors willing to fund loans, often with more flexible terms than traditional lenders.

- Credit Counseling: Seeking help from a credit counseling service can provide guidance on improving credit scores and exploring better loan options.

Conclusion

A $50,000 personal loan with no credit check can be a valuable financial resource for individuals facing urgent monetary needs. However, potential borrowers must weigh the benefits against the risks, including higher interest rates and the possibility of predatory lending practices. By conducting thorough research, understanding eligibility criteria, and considering alternative options, individuals can make informed decisions that align with their financial goals. Ultimately, responsible borrowing practices and financial literacy are essential in navigating the complexities of personal loans in today’s economy.