In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving people in urgent need of money. For these with poor credit histories or instant no credit loans credit history at all, securing a loan can be significantly difficult. However, the demand for quick financial options has given rise to numerous lending choices, including loans that do not require a credit score check. This article explores the implications, options, and issues surrounding the necessity for a loan quick with no credit check.

Understanding No Credit Check Loans

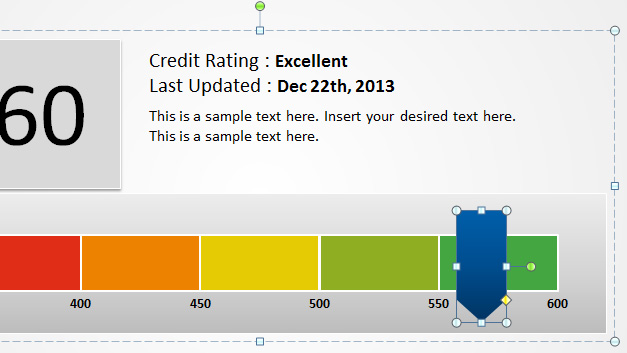

No credit check loans are monetary merchandise that permit borrowers to acquire funds finance without credit check the lender reviewing their credit score historical past. This can be significantly appealing for individuals who have poor credit scores or who haven't established credit. These loans typically include fewer qualifying requirements, making them accessible to a broader vary of borrowers.

Kinds of No Credit Check Loans

- Payday Loans: Considered one of the most typical forms of no credit check loans is payday loans. These quick-term loans are typically due on the borrower’s next payday and are sometimes for small amounts. Whereas they provide fast entry to money, payday loans include extraordinarily excessive-interest rates and charges, which may lead to a cycle of debt if not managed rigorously.

- Title Loans: Title loans permit borrowers to make use of their automobile as collateral to secure a loan. Since the loan is secured by the vehicle’s title, lenders could not require a credit check. Nevertheless, if the borrower fails to repay the loan, they danger shedding their vehicle.

- Personal Installment Loans: Some lenders offer personal loans that don't require a credit score check, especially for borrowers with a gentle income. These loans are sometimes paid back in installments over a set interval, making them more manageable than payday loans.

- Peer-to-Peer Lending: Online platforms connect borrowers with particular person traders keen to lend cash. A few of these platforms might offer loans with out a credit check, relying as a substitute on different information to assess the borrower’s skill to repay.

Pros and Cons of No Credit Check Loans

Pros:

- Fast Access to Money: One of many most important benefits of no credit check loans is the speed at which borrowers can access funds, typically inside 24 hours.

- Less Stringent Requirements: These loans usually have fewer qualification requirements, making them accessible to individuals with poor or no credit history.

- Flexibility: Borrowers can use the funds for numerous functions, together with medical emergencies, automobile repairs, or unexpected bills.

Cons:

- High-Interest Charges: No credit check loans usually come with exorbitant interest rates and charges, making them a expensive choice in the long term.

- Risk of Debt Cycle: Borrowers may discover themselves in a cycle of debt, borrowing repeatedly to pay off earlier loans, particularly with payday loans.

- Potential for Scams: The lack of regulation within the no credit check loan market can lead to predatory lending practices. Borrowers must be cautious and conduct thorough analysis before securing a loan.

Elements to think about Before Taking a No Credit Check Loan

- Curiosity Rates and Charges: Before agreeing to any loan, it's crucial to know the interest charges and any related charges. Borrowers should calculate the entire value of the loan to ensure it is manageable.

- Repayment Phrases: Understanding the repayment schedule is important. Borrowers ought to guarantee they'll meet the repayment phrases with out jeopardizing their monetary stability.

- Lender Fame: Researching the lender’s reputation may also help borrowers avoid scams. Reading critiques and checking for correct licensing can present insight into the lender’s reliability.

- Options: Earlier than choosing a no credit check loan, borrowers should discover alternative options such as personal loans from credit unions, borrowing from buddies or household, or seeking help from local charities or neighborhood organizations.

The Importance of Monetary Literacy

Understanding the implications of taking out a no credit check loan is essential for borrowers. Monetary literacy plays a significant function in making informed choices about borrowing. People should educate themselves on interest charges, repayment phrases, and the potential penalties of defaulting on a loan.

Conclusion

The necessity for a loan fast with no credit check generally is a tempting answer for those going through financial emergencies. While these loans supply quick access to cash, they come with important risks, together with excessive-interest rates and the potential for falling into a cycle of debt. Borrowers should carefully consider their choices and ensure they perceive the terms and implications of any loan they pursue. By prioritizing financial literacy and exploring all accessible options, people can make informed choices that assist their lengthy-time period monetary well being.