In recent times, the recognition of Gold Individual Retirement Accounts (IRAs) has surged as investors seek to diversify their retirement portfolios and hedge against inflation. Gold IRAs enable individuals to invest in bodily gold and Bonhommeproperties.com different treasured metals as a part of their retirement financial savings. This report delves into the essential details surrounding Gold IRA companies, together with their advantages, options, and key concerns for potential buyers.

What's a Gold IRA?

A Gold IRA is a specialised type of self-directed IRA that allows traders to hold bodily gold, silver, platinum, and palladium of their retirement accounts. Not like conventional IRAs that usually hold stocks, bonds, and mutual funds, Gold IRAs present a singular alternative to put money into tangible property. The interior Income Service (IRS) regulates these accounts, making certain that they meet particular criteria concerning the types of metals that can be held and the storage necessities.

Advantages of Investing in a Gold IRA

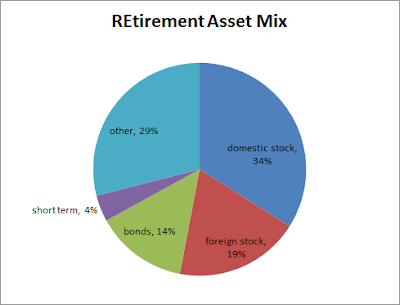

- Diversification: One of the primary causes buyers select Gold IRAs is to diversify their retirement portfolios. Gold usually behaves otherwise than stocks and bonds, providing a hedge in opposition to market volatility.

- Inflation Hedge: Gold has traditionally maintained its worth throughout inflationary periods. As the buying power of fiat currencies declines, gold tends to understand, making it a reliable store of worth.

- Tax Benefits: Like traditional IRAs, Gold IRAs offer tax-deferred development. Traders can postpone taxes on features till they withdraw funds during retirement.

- Tangible Asset: Not like stocks and bonds, gold is a physical asset that buyers can hold. This tangibility can present peace of mind, particularly throughout financial uncertainty.

- Wealth Preservation: Gold has been considered a safe haven asset for centuries. It will help preserve wealth throughout generations, making it a gorgeous option for long-term retirement planning.

Choosing a Gold IRA Company

Deciding on the best Gold IRA company is crucial for a profitable investment experience. Listed below are key components to consider when evaluating potential providers:

- Reputation and Credibility: Research the company’s status in the industry. Search for opinions, testimonials, and scores from independent sources. A reputable firm should have a monitor report of optimistic customer experiences and clear enterprise practices.

- Fees and Costs: Perceive the charge construction of the Gold IRA company. Common charges embody setup charges, storage charges, and transaction fees. Evaluate the prices among different suppliers to ensure you're getting a fair deal.

- Choice of Valuable Metals: Not all Gold IRA companies offer the identical number of metals. Make sure that the corporate gives quite a lot of funding options, including gold coins, bars, and different valuable metals, to fit your affordable investment plans in gold iras strategy.

- Storage Options: Gold have to be saved in an IRS-authorised depository. If you treasured this article and you also would like to acquire more info regarding trusted retirement with gold ira kindly visit our webpage. Inquire concerning the storage choices offered by the company and ensure they offer safe, insured facilities.

- Customer service: Good customer support is essential for a easy investment experience. Choose an organization that provides responsive support and is willing to reply your questions and provide guidance throughout the process.

- Instructional Assets: A good Gold IRA company ought to offer educational assets to help traders understand the market and make knowledgeable selections. Search for affordable firms for gold-backed iras that present market evaluation, investment guides, and common updates.

Standard Gold IRA Companies

A number of Gold IRA companies have established themselves as leaders within the business. Here are some of probably the most respected ones:

- Goldco: Goldco is probably the most effectively-known Gold IRA companies, offering a wide range of precious metals and exceptional customer support. They supply traders with educational sources and have a robust repute for transparency and integrity.

- Birch Gold Group: Birch Gold Group specializes in helping people convert their present retirement accounts into Gold IRAs. They've a knowledgeable workforce that guides investors by the process and presents a variety of funding choices.

- Noble gold ira investment firms 2024 Investments: Noble Gold is known for its customer-centric approach and gives a spread of precious metals for investment. They provide a no-stress gross sales surroundings and focus on educating investors about the benefits of gold.

- American Hartford Gold: American Hartford Gold prides itself on its dedication to customer service and transparency. They offer a diverse selection of treasured metals and provide traders with access to market insights and academic sources.

- Regal Assets: Regal Belongings has gained recognition for its progressive method to Gold IRAs and various investments. They provide a wide range of valuable metals, cryptocurrencies, and different different belongings, catering to a diverse investor base.

Steps to Open a Gold IRA

Opening a Gold IRA includes several steps. Here’s a simplified process to information potential traders:

- Select a Custodian: Select a good Gold IRA company to function your custodian. This company will manage your account and guarantee compliance with IRS laws.

- Fund Your Account: You possibly can fund your Gold IRA through various strategies, together with rolling over funds from an present retirement account or making a direct contribution.

- Choose Your Valuable Metals: Work together with your custodian to decide on the varieties and portions of valuable metals you wish to spend money on. Be certain that you choose IRS-accepted metals.

- Storage Arrangements: Your custodian will arrange for the safe storage of your valuable metals in an IRS-permitted depository.

- Monitor Your Funding: Frequently evaluate your Gold IRA performance and stay informed about market traits. Modify your funding strategy as wanted to align with your retirement objectives.

Conclusion

Investing in a Gold IRA generally is a strategic move for people trying to diversify their retirement portfolios and protect their wealth from economic uncertainties. By understanding the advantages, selecting a good Gold IRA company, and following the proper steps to open an account, traders can harness the power of valuable metals to safe their monetary future. As with all funding, it is crucial to conduct thorough analysis and consult with financial advisors to make knowledgeable decisions that align with particular person retirement targets.