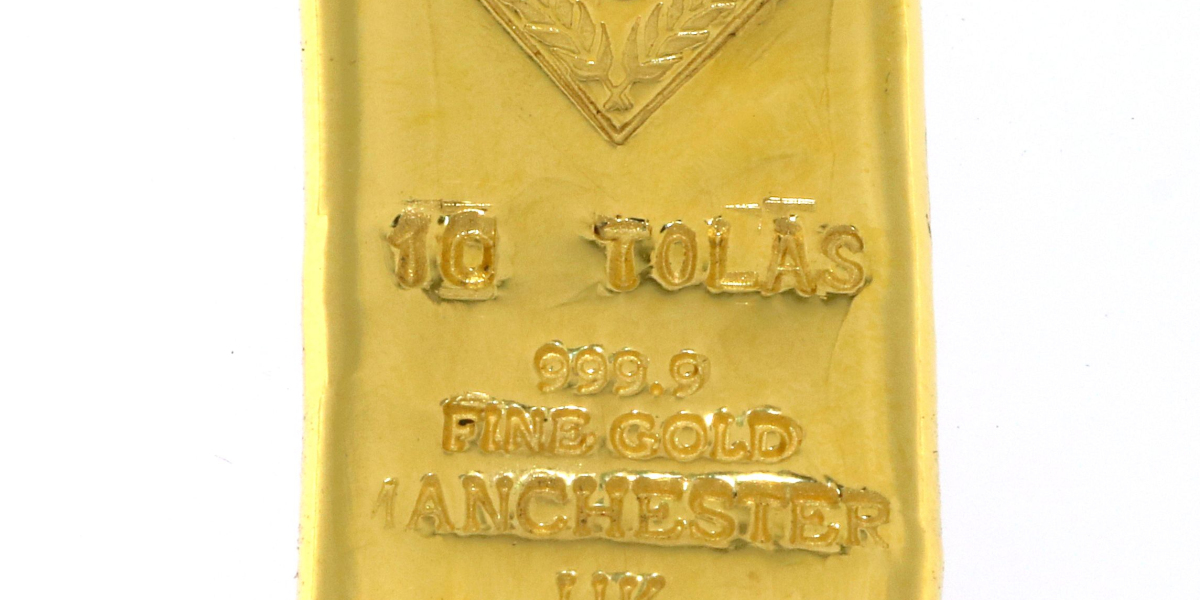

When we talk about gold—not just in terms of jewellery but as an investment—one of the key benchmarks in the UK market is the price of a 10 tola gold bar price in uk. Before diving into jewellery specifics, let’s first understand what that means and where things stand today.

What is a “tola”?

The tola is a historical South Asian unit of mass (used in India, Pakistan and neighbouring regions). It is defined as 180 grains, which translates to approximately 11.66 grams

So a 10 tola bar weighs roughly 116.6 grams of gold.

What is the current 10 tola gold bar price in the UK?

According to live price feeds:

The rate for 1 tola (24 ct gold) in the UK is about £1,161.52.

Therefore, 10 tolas translates to around £11,615.20 (10 × £1,161.52) for 24 ct gold.

Actual retailer listings align in that ballpark: for example, one dealer lists a 10 tola bar at £11,624.15.

Another shows 10 tola bars starting around £12,148.94.

So the headline rate is roughly £11,600–£12,200 for a 10 tola bar in the UK right now, subject to market movements, premiums, availability and supplier.

What influences this price?

Several factors come into play:

Spot gold price: Gold is traded globally, and the spot rate per ounce/gram underpins all bar pricing.

Purity & weight: 10 tola bars are large size (≈116.6 g) and typically high purity (0.999 or 999.9 fine) which adds value.

Premiums above spot: Dealers add a margin for manufacturing, shipping/insurance, stock risk, and their business model. For instance one dealer noted “5.00% above spot – one of the UK’s lowest premiums” for 10 tola bars.

VAT & tax considerations: In the UK, investment gold (bars of certain standards) is VAT-exempt. For example the 10 tola bars listed are noted as “VAT Free” in the UK.

Liquidity & size: A 10 tola bar is relatively large, so while good for investment, it may carry slightly higher handling/transport risk and may be less convenient for resale compared to smaller bars or coins.

What This Means for Gold Jewellery Buyers

While the above focuses on investment gold bars, much of the gold jewellery market in the UK (and globally) is linked to similar price dynamics. Here’s how:

1. Link between gold bar price and jewellery cost

Jewellery is made from gold that ultimately correlates with the spot price of gold plus mark-ups (design, craftsmanship, brand, retail margin).

If a 10 tola bar is priced at ~£11,600, that means the raw gold value for ~116.6 g of pure gold is around that figure (minus whatever premium/mark-up the bar has).

Jewellery often uses less gold (say 10 g, 20 g, etc) and may use 22 ct or 18 ct rather than 24 ct, so the cost per gram may be different. But having the bar-price gives you a good benchmark for raw material cost.

2. Why size and weight matter in jewellery

Larger items (e.g., big necklaces, heavy bangles) will weigh more gold — meaning more cost. If gold is expensive (as current bar prices show), heavy jewellery becomes a truly premium investment.

The purity (karat) also matters: 24 ct jewellery will cost more than 18 ct for the same weight. In investment bars we talk about 24 ct (999 fine) bars; jewellery may use other standards.

3. When it makes sense to buy jewellery vs. bars

Investment bars: Good if you’re buying gold for wealth preservation, expecting to hold and resell. The 10 tola bar pricing above gives you a direct exposure to gold price.

Jewellery: Good if you’re buying to wear, as a gift, cultural/traditional value, or merging both function and investment. But jewellery tends to carry higher mark-ups (design, brand, workmanship) so you pay more than just gold value.

4. Things to watch for as a jewellery buyer

Purity label: Ensure the karat or fineness is clearly marked (e.g., 22 ct, 24 ct).

Weight: Heavier pieces mean more gold content thus more cost, but also more investment value.

Brand/warranty/certification: A reputed jeweller will provide certification of weight and purity.

Market timing: Given gold bar prices are already high (~£11.6k for 10 tola) if you buy jewellery, be aware you’re buying at a high gold price environment (which may affect resale value if gold falls).

Resale vs wear value: Jewellery’s resale value may be lower than bars because of the added workmanship costs, so if you buy mainly for investment, bars are purer exposure; if you buy to wear + invest, jewellery blends both.

Summary

A 10 tola (≈116.6 g) pure gold bar in the UK currently trades around £11,600–£12,200, according to live data and advertised listings.

Jewellery pricing is closely tied to gold bar pricing, 10 tola gold bar price in uk but with added factors (maker’s mark, design, brand, purity, retail margins).

If you’re buying gold jewellery in the UK, use the bar price benchmark (like the 10 tola rate) to judge how much of what you’re paying is gold content vs markup.

If your goal is investment, bars may give cleaner exposure; if your goal includes wearability and aesthetic value, jewellery is valid — just understand you’re paying more than just the raw gold value.

Visit Us : https://www.a1mint.com/