In today’s fast-paced world, monetary emergencies can come up at any second, leaving people and households scrambling for immediate solutions. For many, conventional lending choices is probably not viable on account of poor credit history or a scarcity of credit score historical past altogether. Thankfully, there are avenues obtainable for those looking for loans without the burden of a credit score check. This article explores the choices, benefits, and considerations of obtaining a loan with no credit check, serving to borrowers navigate this typically-overlooked monetary panorama.

Understanding No Credit Check Loans

No credit check loans are financial products that permit borrowers to safe funding with out the lender reviewing their credit score historical past. This can be significantly appealing for people with poor credit score scores, those who are new to credit, or anybody who prefers to keep their monetary history private. These loans can are available various types, including payday loans, personal loans, and title loans.

Types of No Credit Check Loans

- Payday Loans: Payday loans are brief-term, high-curiosity loans sometimes due on the borrower’s next payday. Whereas they supply fast access to emergency cash immediately no credit check, they typically include exorbitant curiosity charges and charges. Borrowers should train warning and ensure they'll repay the loan on time to keep away from falling into a cycle of debt.

- Title Loans: Title loans permit borrowers to make use of their automobile's title as collateral for a loan. The quantity borrowed is normally primarily based on the automobile's value. When you loved this short article and you would love to receive more information regarding no credit check Loans virginia kindly visit our web site. While title loans can provide bigger quantities than payday loans, they also carry the chance of losing the automobile if the borrower defaults.

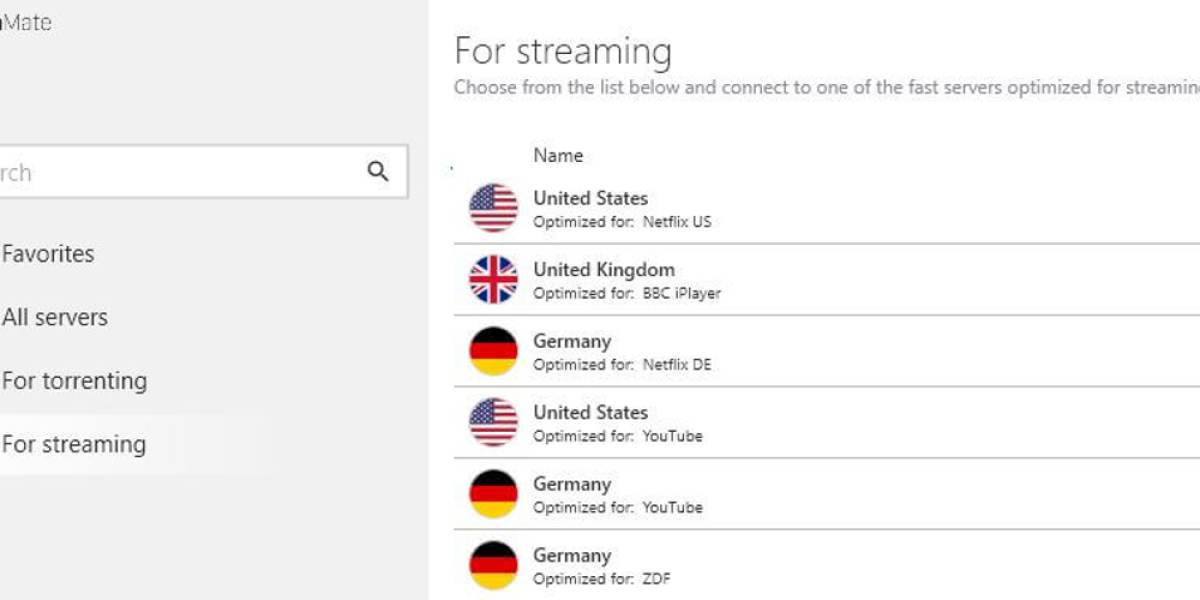

- Peer-to-Peer Lending: This comparatively new approach connects borrowers directly with particular person lenders by way of online platforms. Many peer-to-peer lending platforms don't require a credit check, focusing instead on the borrower’s income and ability to repay the loan.

- Personal Installment Loans: Some lenders offer personal loans that do not require a credit check. These loans are typically repaid in installments over a set interval. Borrowers may have to offer proof of earnings and different financial data to qualify.

Advantages of No Credit Check Loans

- Accessibility: One of the most important advantages of no credit check loans is that they are extra accessible to individuals with poor or no credit history. This inclusivity allows borrowers to access funds once they need them most.

- Velocity of Approval: Many lenders providing no credit check loans can course of applications rapidly, usually providing funds inside just a few hours or by the next enterprise day. This velocity is essential for these going through pressing financial needs.

- Much less Stigma: For individuals who've faced financial difficulties, the prospect of a credit check may be daunting. No credit check loans can alleviate a few of this stress, permitting borrowers to seek help with out worry of judgment.

- Flexible Use: Unlike some loans that are earmarked for particular functions (like home enchancment or schooling), no credit check loans can often be used for any function, whether it’s overlaying medical expenses, automobile repairs, or on a regular basis bills.

Issues and Risks

Whereas no credit check loans can be a lifeline for many, they don't seem to be without their drawbacks. Borrowers ought to bear in mind of the following dangers:

- Excessive Curiosity Charges: Many no credit check loans include considerably larger interest charges than traditional loans. This can lead to borrowers paying back a lot greater than they initially borrowed, notably if they cannot repay the loan on time.

- Brief Repayment Phrases: Many of those loans are designed to be repaid rapidly, typically within just a few weeks. Borrowers may find themselves in a troublesome place if they can't meet the repayment deadline.

- Potential for Debt Cycle: The ease of acquiring no credit check loans can lead to a cycle of debt, where borrowers take out new loans to repay previous ones. This can create a precarious monetary situation that is tough to flee.

- Restricted Loan Quantities: No credit check loans might come with decrease borrowing limits in comparison with traditional loans, which could be an obstacle for those needing larger sums of cash loans without credit check approval.

Ideas for Borrowers

If you find yourself contemplating a borrow 2500 no credit check credit check 400 loan no credit check, listed here are some ideas to make sure you make an knowledgeable decision:

- Analysis Lenders: Not all lenders are created equal. Take the time to research and compare different lenders, their phrases, and customer opinions. Look for reputable companies that are clear about their fees and interest rates.

- Read the Effective Print: Earlier than signing any loan agreement, carefully read the phrases and circumstances. Pay shut consideration to the interest charges, repayment terms, and any fees associated with the loan.

- Assess Your Monetary State of affairs: Earlier than taking on new debt, consider your present financial scenario. Are you able to afford to repay the loan inside the designated timeframe? If not, it could also be finest to discover other options.

- Consider Options: Explore different monetary choices before committing to a no credit check loan. This could embody borrowing from family or pals, negotiating cost plans with creditors, or seeking help from native charities or community organizations.

- Create a Repayment Plan: If you happen to determine to proceed with a no credit check loan, develop a transparent repayment plan. Setting apart funds every pay period can help ensure you meet your obligations without falling behind.

Conclusion

No credit check loans can provide important monetary relief for individuals facing unexpected expenses or emergencies. Nonetheless, borrowers must strategy these loans with caution, understanding the potential dangers and prices concerned. By conducting thorough research, assessing their financial state of affairs, and considering various options, borrowers could make knowledgeable decisions that lead to financial stability and success. In a world the place financial freedom is paramount, understanding all available choices is vital to unlocking a safe financial future.